The future of fraud prevention with Trustfull: Frictionless, real-time and powered by OSINT

Our portfolio company Trustfull is redefining the standards for digital risk assessment and online trust.

As generative AI becomes the default for all kinds of customer interactions, trust is now both a competitive advantage and a compliance imperative. Whether you’re onboarding a new customer, verifying a returning user, or flagging high-risk transactions, knowing who is behind the screen, without slowing them down, ismission-critical.

Yet, most risk tools are outdated and relying heavily on document-based ID checks that are easy to spoof and frustrating for users. Fraudsters are also getting smarter, using synthetic identities, deepfakes, and social engineering to slip through the cracks of traditional verification processes at a higher rate.

With new legislation like the AML Regulation and eIDAS 2.0 coming into force in Europe, the bar for fraud prevention and KYC compliance is only getting higher. In this context, the market is ready for a new approach: one that’s silent,

scalable, and built for the real-time web.

The Opportunity: Real-Time Digital Trust Is the Next Frontier

With increasing regulatory pressure, rising fraud rates and growing consumer demands, the market for intelligent, low-friction fraud prevention solutions is accelerating. In fact, the global fraud detection and prevention market is projected to nearly triple from $33.1billion in 2024 to $90 billion by 2030.

This growth is driven especially by high demand for innovation across sectors like fintech, banking, lending, and payments, where legacy ID verification and risk assessment tools are integrated with innovative solutions that deliver accurate and instant decision-making.

This is where Trustfull steps in. With a silent, signal-based approach to fraud prevention, they help businesses identify risky users instantly, without ever interrupting the user journey for legitimate customers.

Rebuilding Digital Trust for Regulated Industries, Silently and at Scale

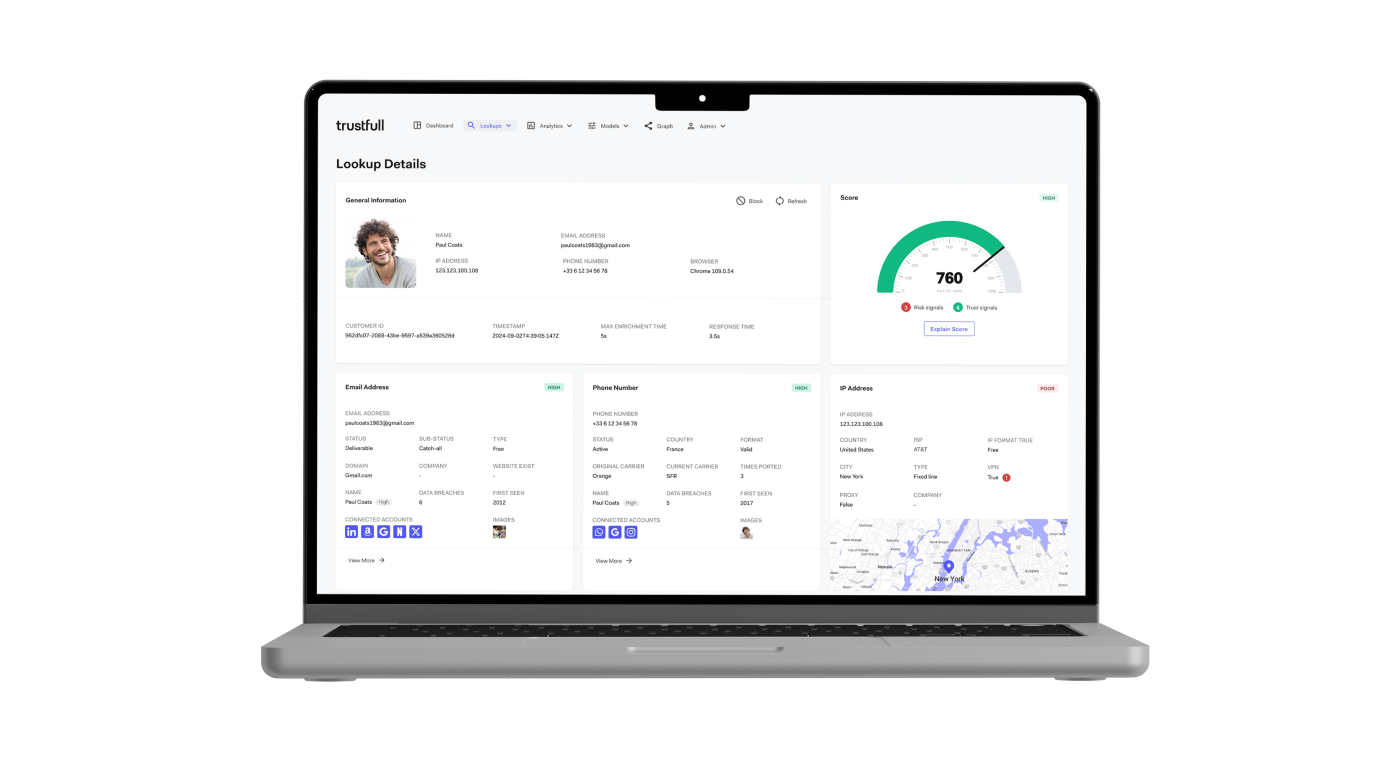

Backed by cybersecurity experts and a high-caliber team with vast experience in scaling businesses, Trustfull helps assess the risk level of users from their first

digital interaction, performing passive Open Source Intelligence (OSINT) checks on associated phone numbers, emails, IP addresses and domain names andleveraging a suite of specialized AI agents.

Some risk indicators instantly uncovered by Trustfull are, for example, newly registered email addresses, disposable or suspicious phone numbers, IPs associated with VPNs or known fraud clusters, and domains lacking historical web presence. The platform also detects other anomalies, like inconsistencies in geolocation, mismatched email/phone usage across regions or multi-accounting attempts from the same IP address, for additional insights and more effective fraud prevention.

For customers across financial services and regulated sectors, the main benefits of the Trustfull platform include:

- Faster onboarding of both retail and business customers

- Accurate detection of new account fraud attempts

- Lower overall fraud losses through early-stage risk flagging

- Reduction of manual effort during the verification process

- Effective account takeover prevention through silent checks at login

Unlike black-box solutions, Trustfull is powered by an explainable rule engine that can be easily customized to meet clients’ specific needs and all scoring decisions are backed by auditable insights. Their modular platform is designed to operate across sectors and countries, adapting to both local regulations and global risk vectors.

The Road Ahead: From Fraud Prevention to a Trust Layer for the Internet

Trustfull’s long-term vision is ambitious: to become the invisible trust layer powering every meaningful digital interaction, from fintech and banking to crypto, e-commerce and beyond.

As platforms grow more interconnected and compliance becomes a shared responsibility, real-time, intelligent trust scoring will be foundational infrastructure to ensure growth.

The future of fraud prevention with Trustfull: Frictionless, real-time, powered by OSINT | Blog | Elevator Ventures

At Elevator Ventures, we are excited to back Trustfull, a category-defining company operating at the

intersection of fraud prevention, compliance, and AI. By empowering businesses to move beyond reactive defense toward proactive and fully silent fraud prevention, Trustfull unlocks faster growth, stronger margins, and an enhanced

customer experience, aligning with our mission to support Fintech & Beyond Banking companies driving realimpact and innovation.

To learn more about Trustfull’s frictionless fraud prevention solutions, visit trustfull.com or follow them on LinkedIn.