kompany-Genesis of succesful exit | Blog | Elevator Ventures

kompany is acquired by Moody’s. That is a huge success for the founders and the whole team of kompany and the result of years of hard work. For the Corporate Startup activities of Raiffeisen Bank International (RBI), it also creates a textbook example of how collaboration with startups can be successful.

Bringing Know-Your-Business to the next level

kompany is the leading RegTech platform for Global Business Verification and Business KYC (KYB). Their global network provides real-time access to audit-proof authoritative data from commercial registers and financial and tax authorities in more than 200 jurisdictions, covering over 110 million companies.

The registers network, supercharged through kompany’s four products (including its API and shareholder identification tool; UBO Discovery) help financial institutions, payment service providers, insurers and other regulated companies to automate their due diligence processes and meet the requirements of the latest anti-money laundering regulations.

Based in Vienna, Austria, kompany is a government-licensed clearing house and official distributor for commercial registers in many countries around the world.

Corporate Startup Collaboration works

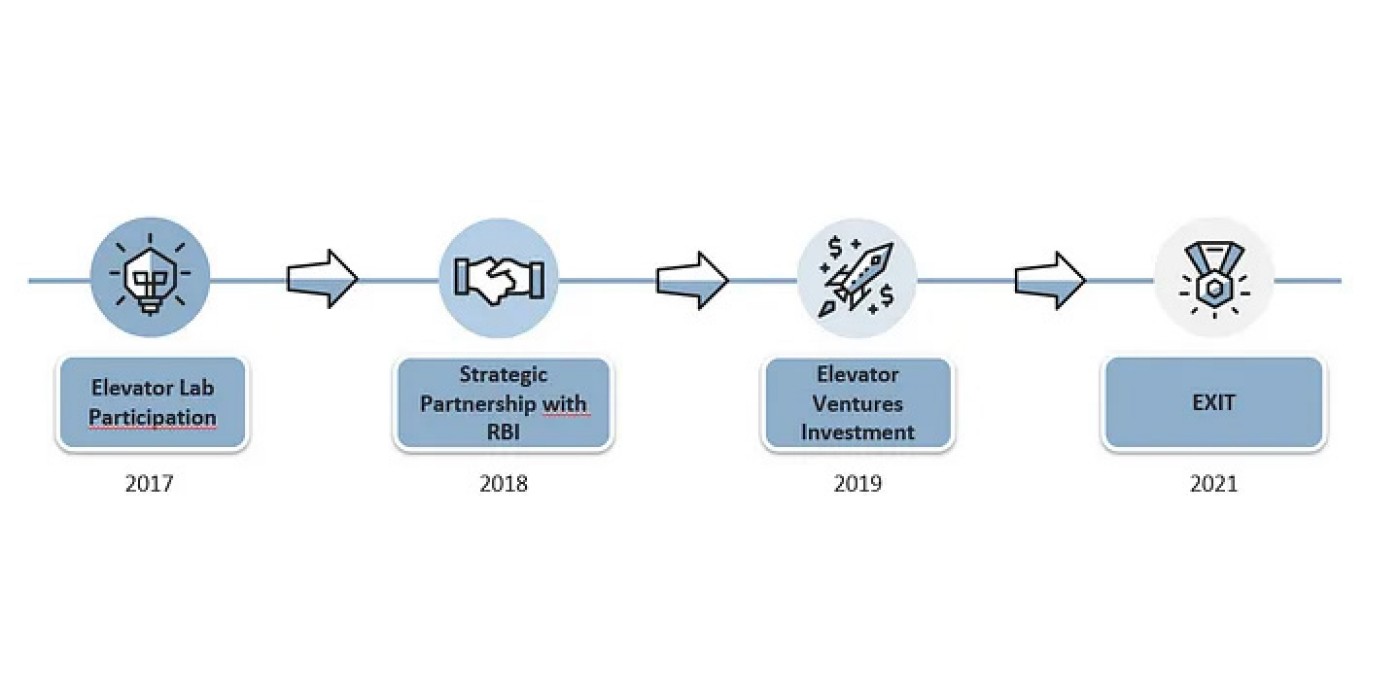

As a participant of the first round of Elevator Lab, the Fintech partnership program of RBI, kompany was running through a 4-month rigorous program during which they successfully piloted the cooperation between kompany and RBI.

As you can see on the scribble of kompany’s flip chart from their pitch, the idea was to develop their existing product into an enterprise-ready KYC tool suitable for bank’s corporate customers. During these four months there was an intense back-and- forth between Kompany’s developers team and RBI’s Customer Data team — but in the end both sides were satisfied with the results. Just shortly after the end of the program, kompany became an integral part of RBI’s e-KYC onboarding process for Corporate Clients.

After Enterprise proof-of-concept, scaling with Elevator Ventures investment

After the successful PoC and a follow-on project with RBI’s Customer Data team in 2019 Elevator Ventures decided to invest in kompany. Having followed the team closely, combined with an insider’s look into their product uniqueness, the decision to support the company in scaling in Western Europe and USA was not the toughest one that a VC fund can make. Elevator Ventures and other investors supported company swelling their product to include 110m company files; processing 5bn data points per year. Further growth prospects looked promising too, since kompany was servicing blue-chip financial institutions with massive upscale potential.

kompany have evolved over the past year with a powerful momentum at its back and despite the pandemic successfully grew the team by more than 50% and welcomed 2 new investors to support continued growth: Global Brain, one of the largest venture capital firms in Japan and Fairway Asset Management, a private equity firm based in Switzerland, which joined existing investors European Super Angels Fund, UNIQA Ventures, Hermann Hauser Investment and Elevator Ventures in the backing of kompany.

kompany’s success and unique value proposition sparked the interest of Moody’s Analytics, which is a subsidiary of Moody’s Corp, a global provider of economic research regarding risk, performance and financial modeling, as well as consulting, training and software services. The US behemoth quickly realized that kompany’s entity verification services fit natively into its platforms and complement collective KYC services. Moody’s also realized what a unique and scarce asset kompany has built and after a rapid, but intensive process ended up with acquiring kompany. Together, both companies have the opportunity to access broader range of business verification resources in new markets and geographies.

Elevator Ventures is the Corporate Venture Capital entity of Raiffeisen Bank International (RBI). Its primary focus is on early stage and growth investments in fintechs and related enabling technologies in Central and Eastern Europe.